Total margin meaning

25 of the total purchase amount the brokerage firm may make a margin call. It is often considered as a core profitability metric.

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

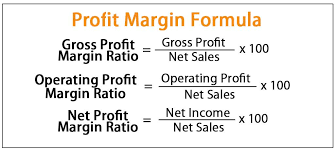

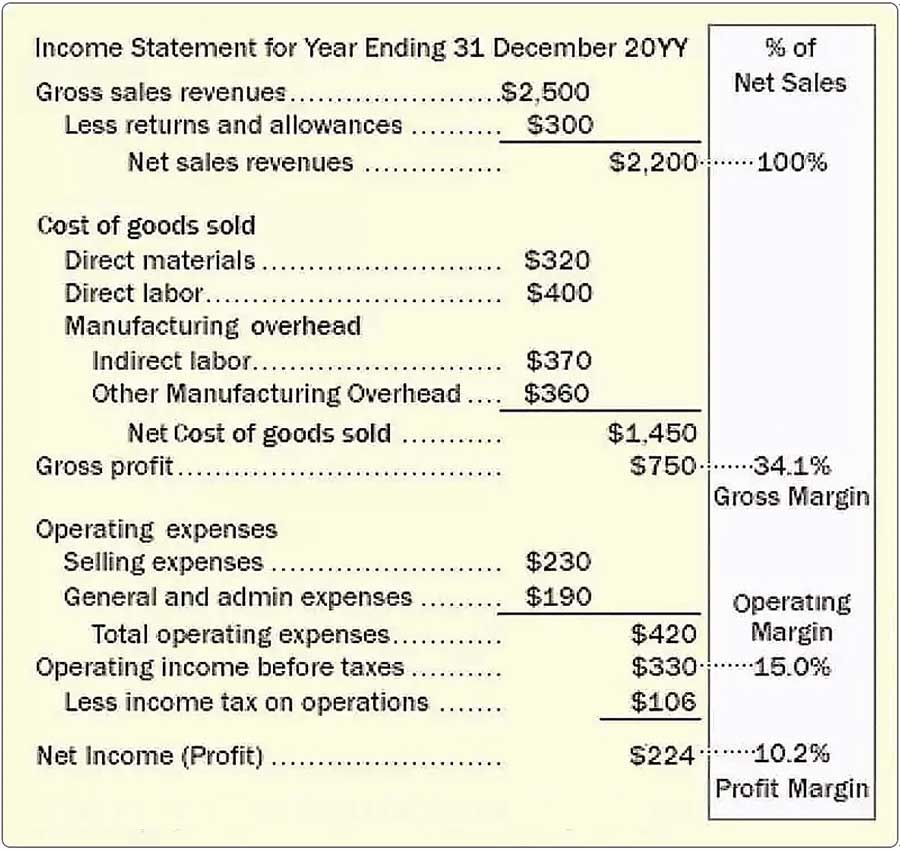

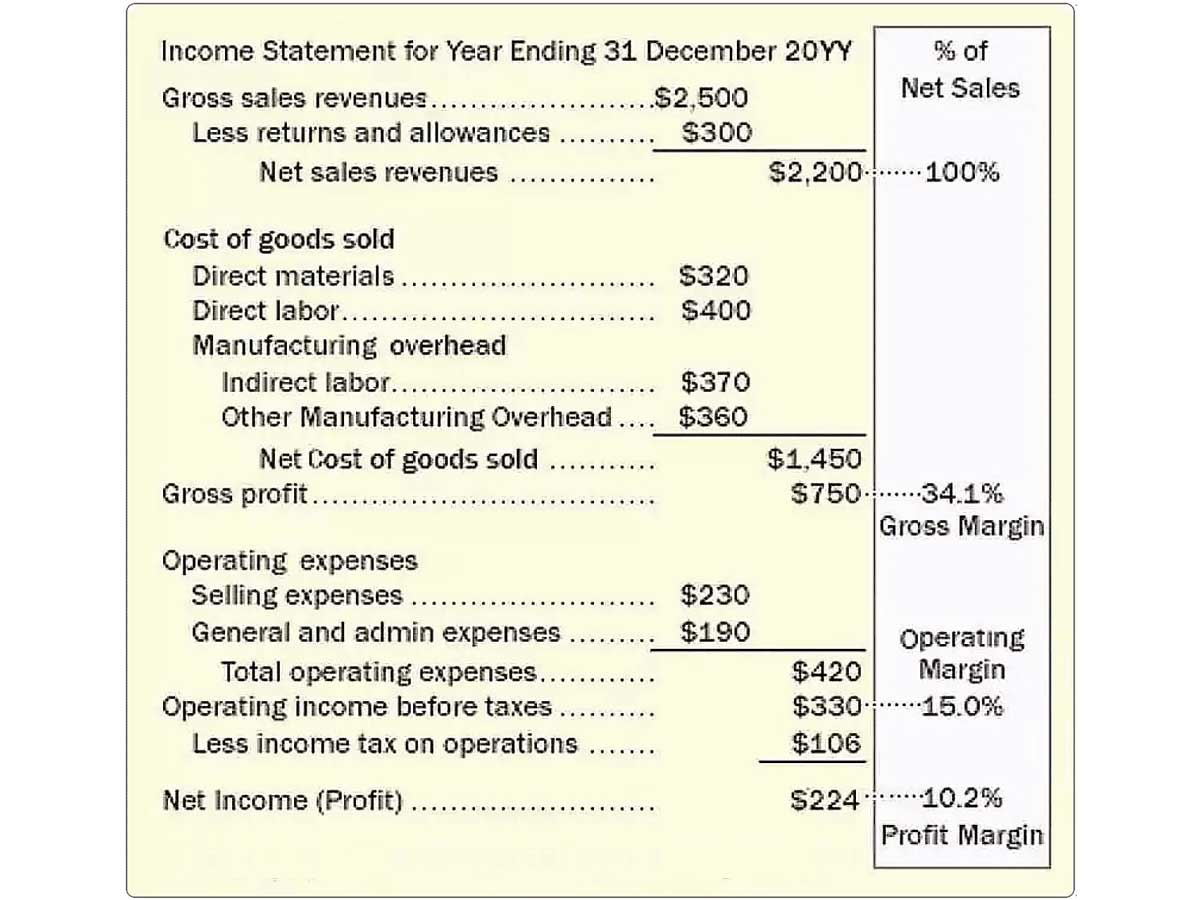

The net profit margin is typically expressed as a percentage but can also take decimal form.

. Margin is a double-edged sword which means that losses are also magnified. The formula is net sales - cost of goods sold net sales. For example for Nestle Return on Equity decreased from 207 in 2014 to 148 in 2015.

The Operating Profit Margin indicates the amount of Operating Profit that the company makes on each dollar of sales. In terms of computing the amount. Return on Equity Meaning.

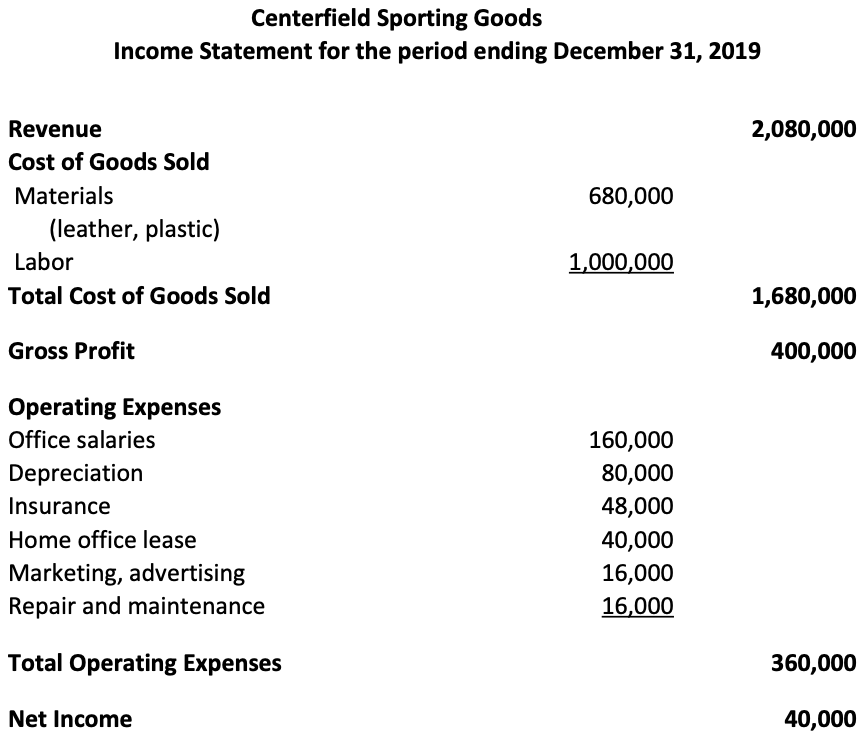

Contribution margin presented as a or in absolute dollars can be presented as the total amount amount for each product line amount per unit product or as a ratio or percentage of net sales. Total gross profit was 12 billion an increase of 75 YoY or 41 excluding the impact of the FC fire in 2021 and gross profit margin improved over 250 bps QoQ. Gross margin is the amount of profit left after subtracting the cost of goods sold from revenue while contribution margin is the amount of profit left after subtracting variable costs from revenue.

Business days provided that the number of day trades represents more than six percent of the customers total trades in the margin account for that same five business day period. Customers should note that this rule is a. 75 billion people 19 liters 032 price per liter 120 margin 365 days 201 trillion TAM.

The Margin of Safety represents the downside risk protection afforded to an investor when the security is purchased significantly. Cost of Sales 1000. Net profit margin is the ratio of net profits to revenues for a company or business segment.

The three margin calculations in finance accounting are. Operating Profit Margin meaning. Let us Operating expenses for both the companies.

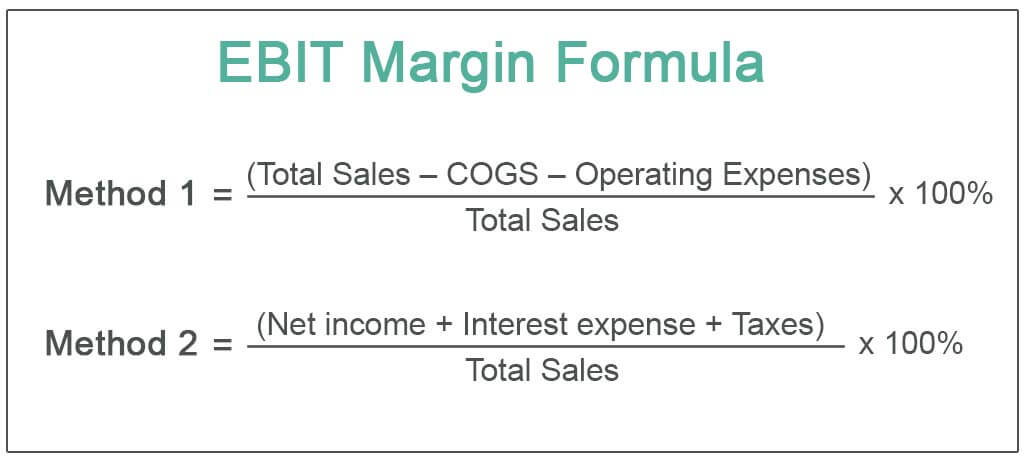

For example lets say you use 5000 in cash and borrow 5000 on margin to purchase a total of 10000 in stock. Formula for Contribution Margin. EBITDA margin EBITDA Total Revenue.

It is the percentage of selling price that is turned into profit whereas profit percentage or markup is the percentage of cost price that one gets as profit on top of cost priceWhile selling something one should know what percentage of profit one will get on a particular investment so. Your equity would fall to 4000 which is the market value minus the loan balance of 5000. This has been a guide to the Contribution Margin and its meaning.

Here we discuss the formula to calculate Contribution Margin and practical examples and excel templates. By determining a percentage of EBITDA against your companys overall revenue this margin gives an indication of how much cash profit a business makes in a single year. The net profit margin is a consideration or net profit net income as a percentage of the companys revenue.

Additionally if investor equity in the account drops past a certain point eg. This is the gross profit divided by net sales. Net profit margin calculation.

Different financial terms can become confusing and understanding the difference between similar-sounding terms such as gross net revenue income sales and receipts will help. Typically expressed as a percentage net profit margins show how much of each dollar collected by a. Read more provide us with the same answer.

Meaning theyre unlikely to change but. Knowing a products gross margin or the companys overall gross margin helps the business owner or manager know how much of the revenue is retained as gross profit. Other expenses 400.

The formula is Return on Equity ROE Profit Margin Total Asset Turnover Leverage Factor. While you might think your sales and receipts will always equal thats not necessarily true. Defined Contribution Plan Example.

However DuPont analysis helps us analyze why there was an increase or decrease in ROE. Profit margin is calculated with selling price or revenue taken as base times 100. The margin of safety is the total amount of revenue that could be lost by a.

Suppose the market value of the stock youve purchased for 10000 drops to 9000. Total Net Sales 3000. If your business has a larger margin than another it is likely a professional buyer will see more growth potential in yours.

The margin of safety is 25 meaning that the share price can drop by 25 before reaching the estimated intrinsic value of 8. In other words net profit margin is the ratio of net income to revenues for a given company. That means within a few days youll need to deposit more cash or sell some of the shares to offset allpart.

Net loss improved 134 million. You may also look at the following articles to enhance your financial skills. Margin Rules for Day Trading.

The recommended amount of water per day for people is 19 liters there are 75 billion people in the world and with the average of 032 per liter and a 20 margin the TAM of bottled water would be the following. Contribution Margin Net Sales Revenue Variable Costs.

What Is Margin In Trading Meaning And Example

What Is A Margin Definition And Meaning Market Business News

Ebit Margin Formula Excel Examples How To Calculate Ebit Margin

Gross Profit Margin Vs Net Profit Margin Formula

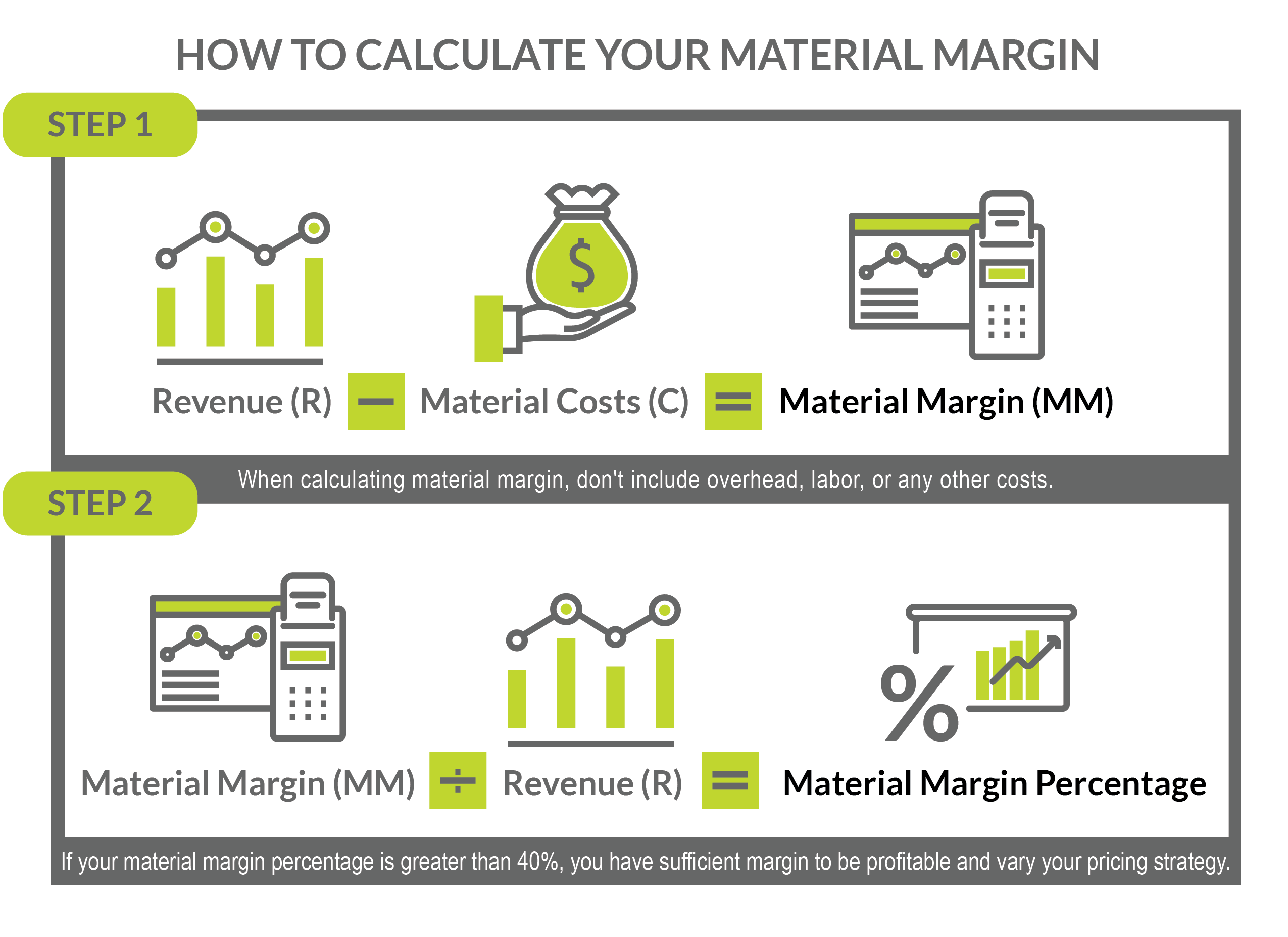

How To Calculate Material Margin And Drive Competitive Pricing

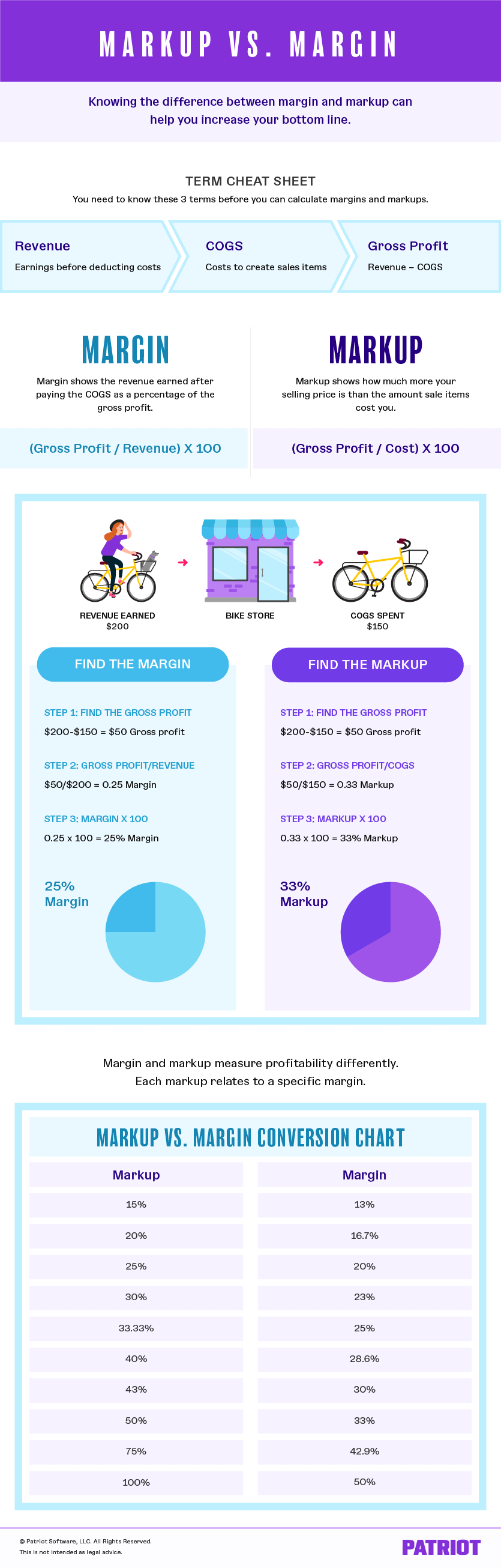

Margin Vs Markup Chart Infographic Calculations Beyond

What Is Gross Margin And How To Calculate It Article

Gross Profit Margin Vs Net Profit Margin Formula

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

What Is Margin Babypips Com

What Is Margin Babypips Com

/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

3 Benefits Of Understanding Your Margins

Margins Measure Business Profitability And Reveal Leverage

Margins Measure Business Profitability And Reveal Leverage

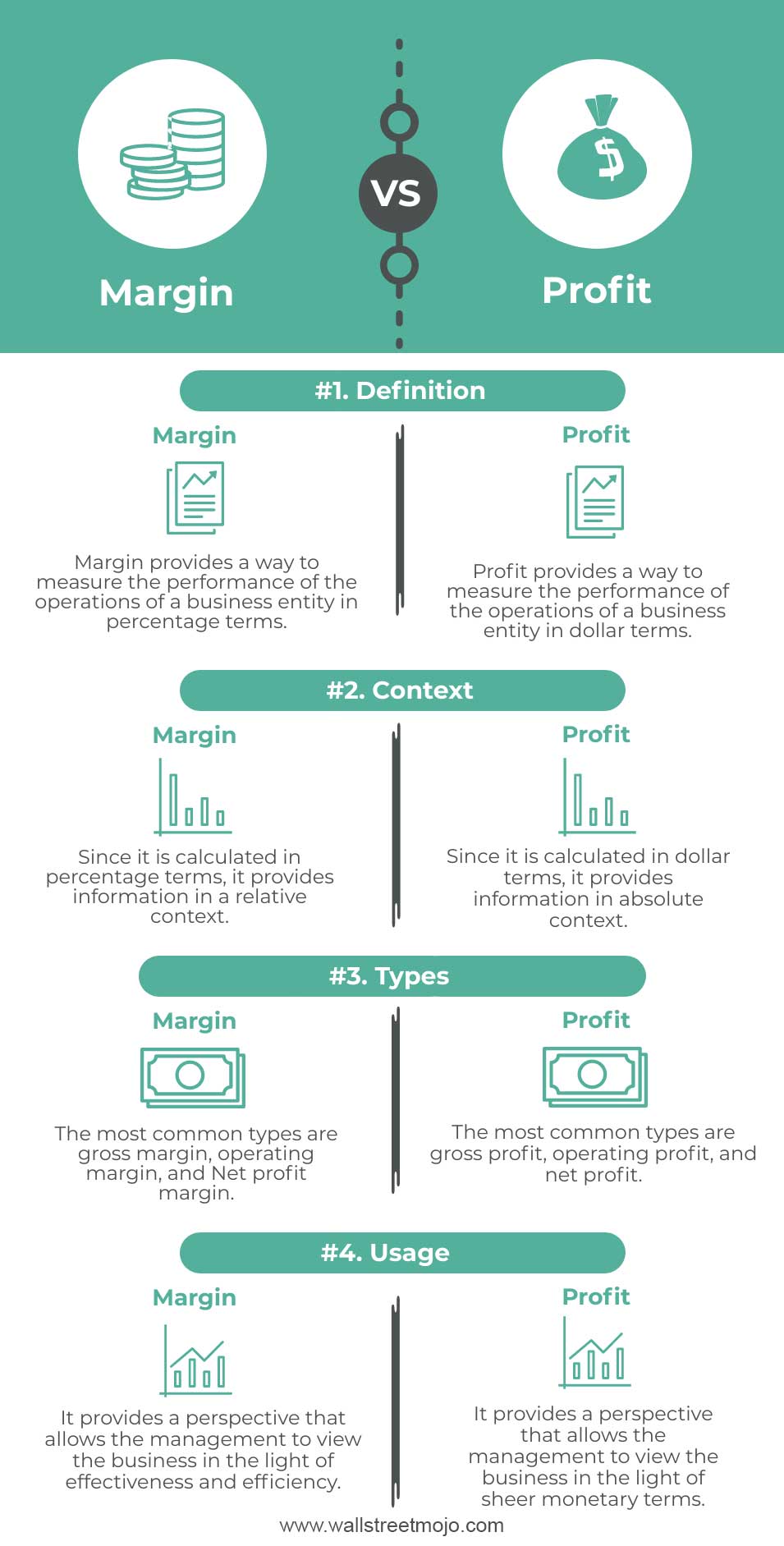

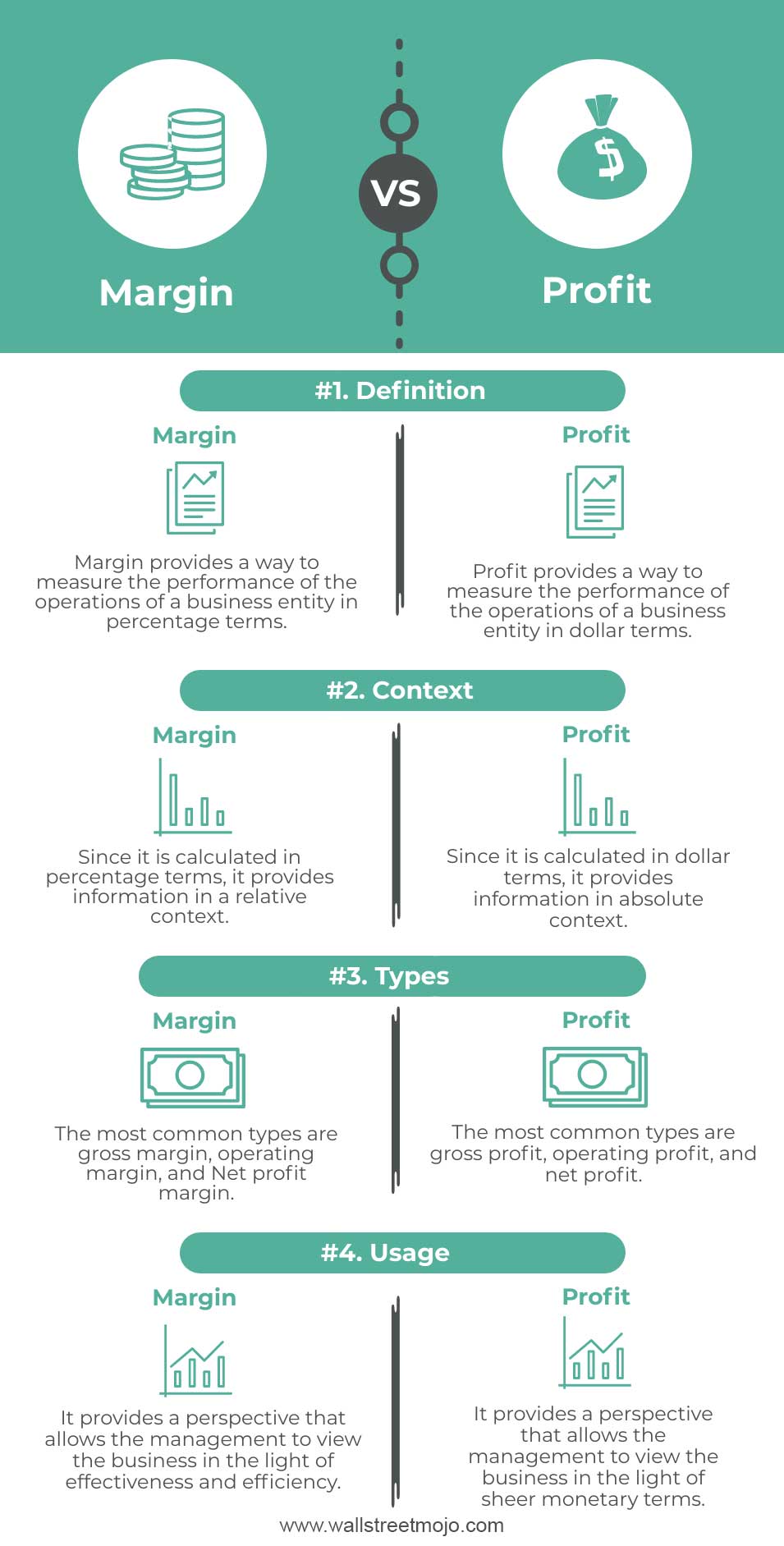

Margin Vs Profit Top 4 Difference With Infographics

What Is Margin Level Babypips Com